Grabbing the right commercial space is crucial for businesses. With proper utilization and strategies, a good office location can bring in huge business for any organization. Since every penny matters in a business operation, every decision has to be precise for optimum efficiency and profitability. Getting your hands on a commercial property is no different. All organizations have unique operations, cultures, strategies, and values. Therefore, the decision to buy or rent commercial space is purely subjective and depends on several factors. Recent trends show that for commercial property, it is easier and more cost-effective to go for a rental. However, both buying and renting commercial properties have pros and cons. As a decision maker, you should choose the option that best suits you and the company. And to help, we have a few factors you should consider whether to buy or rent commercial space.

Up-front Costs

Obviously purchasing a commercial property will incur a large upfront cost, even if you take loans from financial institutions. You may choose to pay in installments but that cash flow is likely to be huge considering other business expenses. Therefore, you need to have sufficient business assets to generate you at least the working capital to run the business. Usually, it requires years of planning and so you must take the decision early if you want to buy or rent commercial space.

On the other hand, renting an office space will still generate a considerable up-front cost amount. Still, it is likely to be less than of purchasing the property. Usually, landlords require a downpayment for at least 3 months or so for their safety and to enforce the contract. But once you are clear of these payments, you are hassle free for the next 3 months.

Monthly Recurring Costs

Buying the property may cost you a large sum of money but once you clear all the obligation, you are free from this hassle. But for a rental commercial property, you will have a constant pressure to meet the rental requirement. Plus, you are also exposed to rental hike risk on every contract renewal cycle. Therefore, if you decide to rent a property, you need to plan and adjust business growth accordingly.

Furthermore, a business is likely to choose a rental property because of the liberty to switch office space. But everytime you switch, it is also a matter of huge expense as well. In contrast, business decision makers choose to purchase property for long term settlement. And therefore in most cases, they don’t need to worry about the shifting cost in a frequent manner. However, it is a common practice in the business world to adjust depreciation expenses but that is a non-cash expense.

Opportunity Costs

Businesses move fast and so the competition is high to grab the best opportunity. Finding the right corporate location at the growing commercial hubs is also regarded as seizing the right opportunity as businesses can leverage on it to grow and earn profits. Now, if you invest in long term settlement in one location and see a good opportunity in another, that’s a cost for you too. It is one of the biggest downsides of purchasing a commercial property. Unless your company is a business giant, then that’s a different case. On the contrary, renting a property means the least possible liabilities. Hence, you are free to pursue the right opportunity at the perfect time.

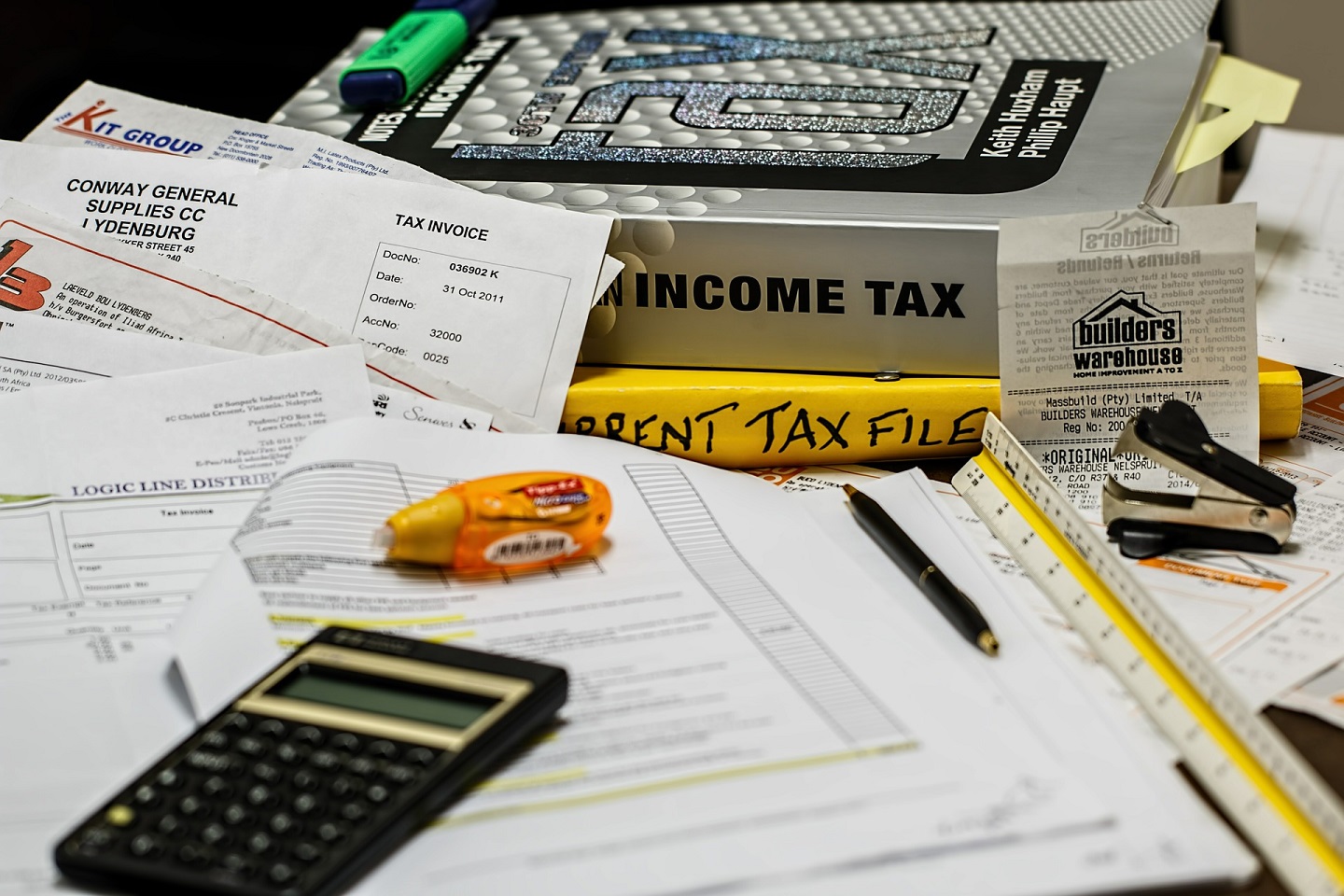

Tax Savings

If you buy commercial real estate, you can deduct the following when calculating tax payments: Interest expense, Depreciation expense and Non-mortgage related expenses. These expenses can be multiplied by an average corporate tax rate to find the tax savings amount. However, since the full amount of the monthly loan payments can’t be deducted (only the interest expense), the tax benefits when buying commercial real estate are typically lower than leasing commercial real estate. On the other hand, there are no such benefits for rental payments as the liability in their contract is the lowest. So, do the math for your business and also project future payment options as well. That way, you will get a better picture of what you are getting into.

Asset Price Appreciation

Lastly, when you purchase and get hold of commercial property, it will automatically increase the equity portion of your business. Hence, if you see interest expenses going up and demand for commercial properties is also increasing, you may experience an asset price appreciation in the future. And once you do, you have the liberty to sell of the asset and purchase/rent another and earn a huge amount for you and for your business. If you are able to depreciate the entire property before selling it, then whatever you make from the transaction is just pure equity for the business.

Most certainly you won’t be able to enjoy this benefit with rental properties but that doesn’t make commercial rent any less lucrative. One, price appreciation for commercial space depends on multiple internal and factors. Two, if you can generate more return from the business without spending on properties then surely you don’t need to invest in an office space.

As mentioned before, the decision to buy or rent commercial space is purely subjective. So, being the decision maker, you should tailor the specification of these factors for your business and weigh out the pros and cons. If you think there are more to consider in this matter, please don’t hesitate to share. Let us know your thoughts in the comments section below!