Whether you co-share a property by inheritance or co-own a property by purchase, when it comes to partitioning the property, you are required to prepare a partition deed that settles the issue on who gets what in detail. And like any other deed, there are certain fees associated with the partition deed. In this article, we will discuss everything from the registration fee of the partition deed to additional charges for each document.

Where else do you need this deed?

Other than serving as legally upheld proof of the distribution of inherited property among the partners, the partition deed is also required to mutate the distributed property to its rightful inheritors or owners. You will also need the partition deed to sell your property. If you want to get a loan against your inherited property, you are required to present this document as well. Also, during a land survey, if you are unable to present this deed, chances are pretty great that you may not get your property recorded.

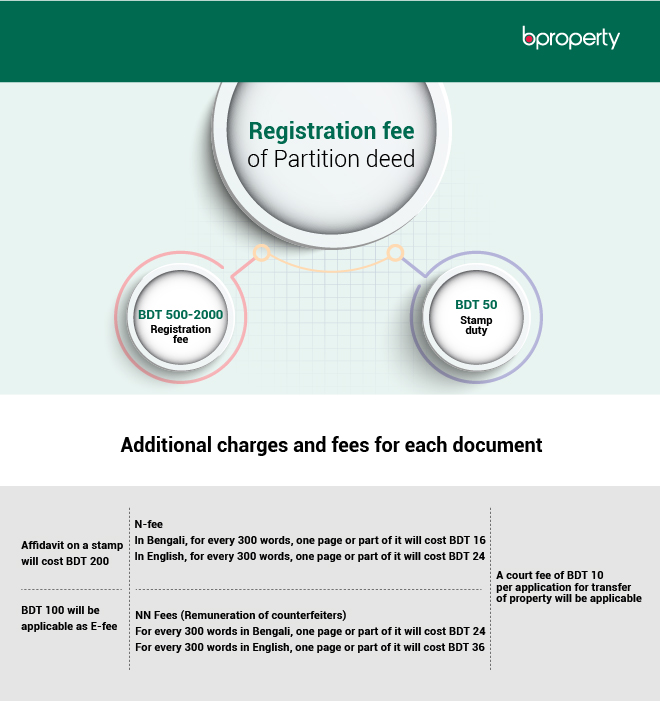

Registration fee of partition deed

Unlike other types of deeds, the registration fee of the partition deed will differ depending on the total value of the property mentioned in the partition deed. However, in this case, the total value is calculated excluding the value of the largest portion. That way, if the total value of the property mentioned in the deed (excluding the value of the largest portion) does not exceed 3 lakh taka then the registration fee would be BDT 500. If it does not exceed 10 lakh taka then the registration fee would be BDT 700. The registration fee would be BDT 1200 and 1800 if the total value of the property mentioned in the deed (excluding the value of the largest portion) doesn’t exceed 30 and 50 lakh taka respectively. But the value exceeds 50 lakh taka then the registration fee would be BDT 2000.

Unlike the registration fee, stamp duty is fixed and you have to pay only BDT 50 for that. There is no capital gain tax but if anyone wishes to sell their portion and make a profit out of it then, they are obliged to pay capital gain tax for that.

Other relevant information

Additional charges and fees for each document:

- Affidavit on a stamp will cost BDT 200

- BDT 100 will be applicable as E-fee

- N-fee

In Bengali, for every 300 words, one page or part of it will cost BDT 16

In English, for every 300 words, one page or part of it will cost BDT 24 - NN Fees (Remuneration of counterfeiters)

For every 300 words in Bengali, one page or part of it will cost BDT 24

For every 300 words in English, one page or part of it will cost BDT 36 - A court fee of BDT 10 per application for transfer of property will be applicable

As we mentioned earlier, you may co-share a property by inheritance or co-own a property by purchase. If you co-own a property by purchase, there is nothing much that you have to do to prepare a partition deed. However, if you co-share a property by inheritance, you have to manage quite a few things in order to prepare the deed. You have to collect the death certificate of the person you have inherited your property from. Then you have to collect a warisan certificate with all the necessary documents of the property.

But most importantly, The Partition Deed has to be documented through the presence and signature of all the participants. If any participant does not agree to distribute the property amicably, the matter is settled through a court case.

Now if you have any questions regarding the registration fee of the partition deed feel free to ask them in the comments section below.

2 Comments

What is BDT2000 charges in executing Partition deed

That is the registration fee but this will vary depending on the total value of the property. As such:

If the total value written in the deed of distributed property is less than BDT 3 lakh – BDT 500.

If the total value written in the deed of the distributed property is between BDT 3 lakh to BDT 10 lakh – BDT 600.

If the total value written in the deed of the distributed property is between BDT 10 lakhs to BDT 30 – BDT 1,200.

If the total value written in the deed of the distributed property is between BDT 30 lakhs to BDT 50 lakhs – BDT 1,600.

If the total value written in the deed of distributed property is more than BDT 50 lakhs – BDT 2,000.