In order to exchange a property’s ownership, you are legally required to register the property through some kind of deed. But depending on the exchange process, the deed will be different. And there are a lot of ways a property can be exchanged. For instance, if someone wants to donate their property to another person or organization, they have to prepare a deed of gift and register accordingly. But what happens when someone wants to sell their property to someone else? This is where saf-kabla or deed of sale comes into play and like any other deed, there are certain fees associated with saf-kabla deed. In this article, we will discuss everything from the registration fee of saf-kabla deed to other important things. But what is saf-kabla deed anyway?

Deed of sale or Saf-kabla deed

In simpler terms, deeds are the legal documentation of an agreement between two or more parties. But in real estate, a deed denotes property-related transactions including property buying or selling, property distribution or transfer. And saf-kabla deed is the deed of sale. It is the legal documentation or a legal record of the ownership exchange agreement between the buyer and the seller.

There are different types of deeds and every deed including saf-kabla deed includes five fundamental information-

- Detailed information about the property

- Proper information or identity of the seller or giver

- Proper information or identity of the buyer or receiver

- Appropriate identification of the witness or witnesses

- A date denoting the completion of the deed

The process and effect

After preparing the deed, the seller must sign the documents and register the property to the buyer’s name. Now the seller may or may not have to come to the sub-register’s office to complete the signing process. Instead, a delegate can do that for the seller. And immediately after paying the registration fee of saf-kabla deed, the buyer will be the owner of the property and the seller and their inheritors will lose all the power over the property.

Registration fee of saf-kabla deed

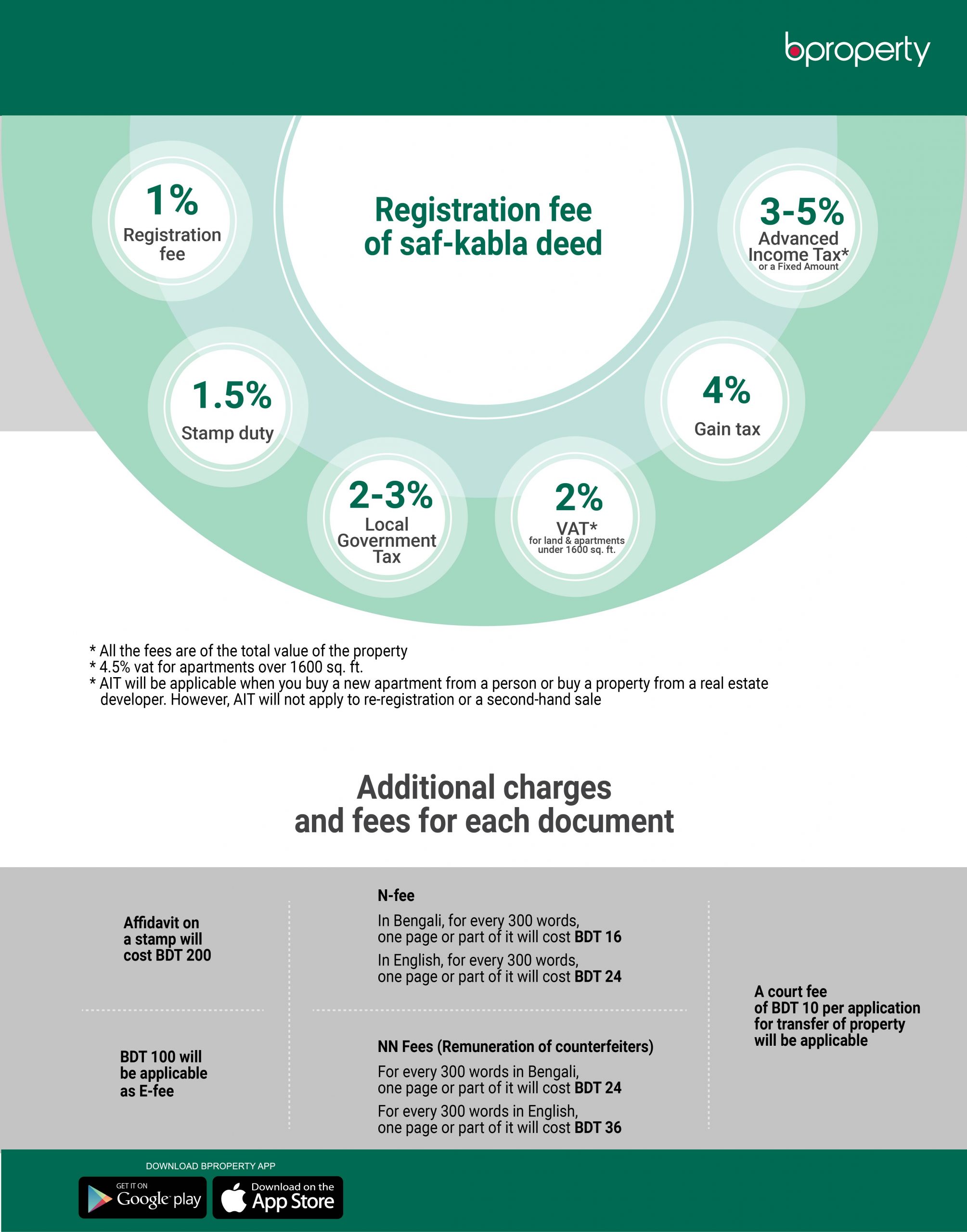

Like we mentioned before, every type of deed has some sort of fees associated with it. Saf-kabla deed is no exception. During the registration process of saf-kabla deed, you have to pay stamp duty, local government tax, and income tax in addition to the registration fee. Here is how much you have to pay during the registration-

Registration fee: 1% of the total value of the property written in the deed.

Stamp duty: 1.5% of the total value of the property written on the deed.

Local Government Tax: 2-3% of the total value of the property written in the deed (depending on the region your property is located)

VAT: 2% for land and small apartment under 1600 sq. ft. but above 1600 sq.ft., the VAT will be 4.5% of the deed value.

Gain tax (53H): 4% of the total value of the property written in the deed or a certain amount per katha depending on the property’s location, whichever is higher.

AIT (53FF): If you buy land from a real estate developer, depending on the property’s location you have to pay an additional 3-5% tax. And in the case of an apartment, flat, space, or building, as a buyer, you have to pay a fixed amount depending on the property’s location. However, AIT will not apply to re-registration or a second-hand sale.

Other important things

In addition to the fees, taxes, and duties mentioned above, the following charges and fees are mandatory for each document:

- Affidavit on a stamp will cost BDT 200

- E-fee: BDT 100 will be applicable

- N-fee

->In Bengal, for every 300 words, one page or part of it will cost BDT 16

->In English, for every 300 words, one page or part of it will cost BDT 24 - (Remuneration of counterfeiters) NN Fees: –

->For every 300 words in Bengali, one page or part of it will cost BDT 24

->For every 300 words in English, one page or part of it will cost BDT 36 - A court fee of BDT 10 per application for transfer of property will be applicable

Apart from all the fees, a buyer needs to pay an additional 0.5% of the total deed value in cash at sub-register’s office as an extra fee. All in all, these are the things that you needed to know about all the additional charges and the registration fee of saf-kabla deed. Saf-kabla deed or the deed of sale is one of the most important documents when it comes to validating the authenticity of a property’s ownership. So knowing every detail will definitely help you understand the overall scenario better.