Before we begin our discussion on how to legally divide property among inheritors, we need to clarify some concepts. First of which is the Partition deed.

A partition deed is prepared to legally divide the inherited property among the inheritors according to their rightful share after determining the total worth of the inherited property.

However, in our country the practice of dividing the property among the inheritors orally is very common. And that is all fine and dandy until someone wants to sell or transfer their portion of the property. So to avoid this unnecessary hassle, you need to prepare a partition deed.

With that being said, here is everything you need to know about the legal process, registration fees, and other duties of the Partition deed.

Regarding the inherited family property, all the heirs can divide their share among themselves if they wish. Also, if one person wants to claim their share of the property but the others do not, then the rest can jointly enjoy the property after handing over his part of the share.

Inherited property can be divided in two main ways:

- Through a court order

- By locally, among themselves

Since the legality for local or family distribution is not very reliable, the possibility of any further complications is further reduced if the property is distributed through a court order. This is why, during distributing an inherited property, all the heirs of the property have to be present and the partition deed has to be prepared with their signature.

Terms of distribution of property

- Measure and mark your land by a skilled land surveyor

- Mention clearly how much space is allocated for which partners and from which part

- This division of property must be recognized and signed by each partner

What needs to be mentioned in the distribution document

Distribution documents need to mention important issues such as ownership of the property and how it is distributed, list of partners, who is getting which part of the property, etc. In addition, who will have the original copy of the deed of distribution and who will present the original deed to other partners if required, all these matters must be included in the Partition deed. All parties to the property partners must participate in the deed of distribution, and if a minor has become a partner in the property, his legal guardian can participate on his behalf.

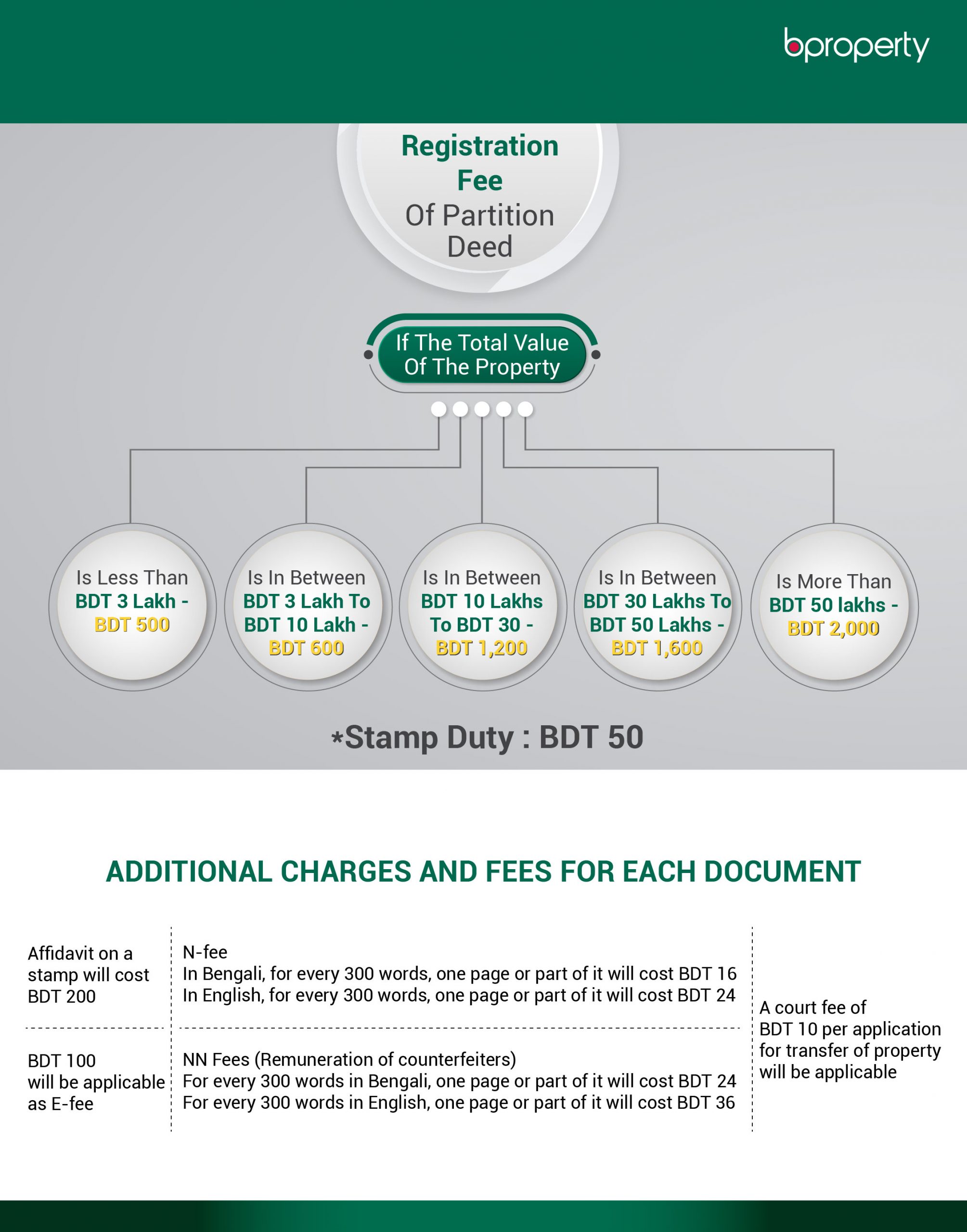

Registration fee for partition deed

- If the total value written in the deed of distributed property is less than BDT 3 lakh – BDT 500.

- If the total value written in the deed of the distributed property is between BDT 3 lakh to BDT 10 lakh – BDT 600.

- If the total value written in the deed of the distributed property is between BDT 10 lakhs to BDT 30 – BDT 1,200.

- If the total value written in the deed of the distributed property is between BDT 30 lakhs to BDT 50 lakhs – BDT 1,600.

- If the total value written in the deed of distributed property is more than BDT 50 lakhs – BDT 2,000.

Stamp Duty: BDT 50

The other important things

In addition to the fees, taxes, and duties mentioned above, the following charges and fees are mandatory for each document:

1. Affidavit on a stamp will cost BDT 200

2. E-fee: BDT 100 will be applicable

3. N-fee

In Bengal, for every 300 words, one page or part of it will cost BDT 16

In English, for every 300 words, one page or part of it will cost BDT 24

4. Remuneration of counterfeiters) NN Fees: –

For every 300 words in Bengali, one page or part of it will cost BDT 24

For every 300 words in English, one page or part of it will cost BDT 36

5. A court fee of BDT 10 per application for transfer of property will be applicable

After the distribution of the property and the registration of the Partition deed, each owner has to complete the mutation of the property to make it their own and pay the government rent including land development tax.