In order to exchange a property’s ownership, you are legally required to register the property through some kind of deed. But depending on the exchange process, the deed will be different. And there are a lot of ways a property can be exchanged. For instance, if someone wants to donate their property to another person or organization, they have to prepare a deed of gift and register accordingly. But if you are a Muslim and want to gift your property by oral declaration to any of your specific family members, you have to prepare a Heba deed. However, like any other deed, there are certain fees associated with a heba deed. In this article, we will discuss everything from the registration fee of heba deed to other important things.

Heba deed

A Heba deed is a type of deed that is in accordance with the Islamic laws where property ownership is gifted or donated without consideration and only with satisfaction. The donor will donate the property completely unconditionally where the recipient will gain access to the ultimate powers over everything including the transfer and conversion of the property. According to Islamic law, any sound of mind and non-minor Muslim can transfer their property through the registry at will. In the past, one required no registration for transferring property through Heba. Just oral declaration was enough but it brought about many complications which ultimately led to mandating registration for this kind of deed with an oral declaration.

There are different types of deeds and every deed including the Heba deed includes five fundamental information-

- Detailed information about the property

- Proper information or identity of the seller or giver

- Proper information or identity of the buyer or receiver

- Proper information or identity of the witness

- A date denoting the completion of the deed

The process and effect

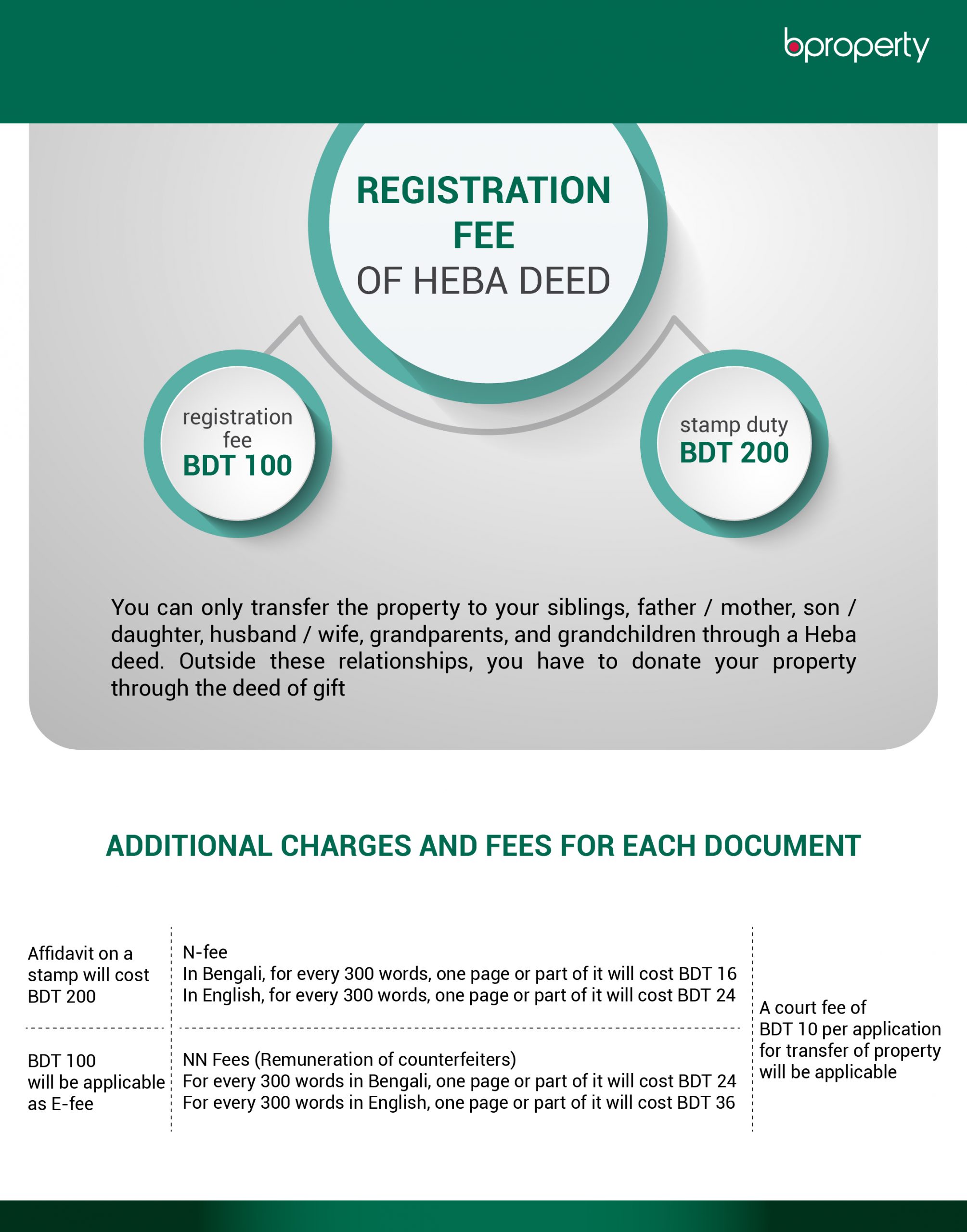

After preparing the deed, the donor must sign the documents and register the property with the recipient’s name. And immediately after paying the registration fee of heba deed, the recipient will become the new owner of the property and the donor and their inheritors will lose all the power over the property. However, you can only transfer the property to your siblings, father/mother, son/daughter, husband/wife, grandparents, and grandchildren through a Heba deed. Outside these relationships, you have to give your property through the deed of gift.

Registration fee of Heba deed

Like we mentioned before, every type of deed has some sort of fee associated with it. The Heba deed is no exception. During the registration process of a Heba deed, you have to pay stamp duty in addition to the registration fee. Here is how much you have to pay during the registration-

Registration fee: BDT 100

Stamp duty: BDT 200

The other important things

In addition to the fees, taxes, and duties mentioned above, the following charges and fees are mandatory for each document:

- Affidavit on a stamp will cost BDT 200

- E-fee: BDT 100 will be applicable

- N-fee

In Bengal, for every 300 words, one page or part of it will cost BDT 16

In English, for every 300 words, one page or part of it will cost BDT 24 - (Remuneration of counterfeiters) NN Fees: –

For every 300 words in Bengali, one page or part of it will cost BDT 24

For every 300 words in English, one page or part of it will cost BDT 36 - A court fee of BDT 10 per application for transfer of property will be applicable

All in all, these are the things that you need to know about all the additional charges and the registration fee of the Heba deed. Heba can become one of the most important documents when it comes to validating the authenticity of a property’s ownership. So knowing the details will definitely help you have a clearer understanding.

1 Comment

vey helpful